Stricter Controls on Illegal New Car Export, More Space for Legitimate Used Cars, and Emerging Opportunities for International Model New Cars

Zhijun Zhao · 2025-11-30

Jeremy Jiang · 2024-03-26

Whether you are an individual used car buyer or an international used car trader from Ghana, this guide will help to facilitate your import business with the substantial knowledge of taxation, documentation, national import policy and customs clearing, which will absolutely ensure you a smooth transaction when importing cars from China to Ghana.

For years, Ghana has been a used car importer in West Africa, with annually approximately 90,000 units used cars imported from overseas. As Chinese automobile brands are winning wider recognition on the international stage, more and more Chinese used cars will be added into Ghana’s shopping cart, especially electric cars from China. This piece of blog will tell you the basic knowledge you need to import from China to Ghana.

Vehicle Importation and Clearing in Ghana:

Importing a vehicle involves the process of purchasing, shipping, and clearing the vehicle once it arrives in the country. When purchasing and shipping a vehicle, all relevant documentation must be kept properly to ensure a smooth clearance process. And for importation, you have to fully understand the duty and taxation policies in Ghana.

Vehicle Duty Calculation:

1. The first purchase price, which is the manufacturer’s price at the time the car was manufactured is needed for Vehicle Duty Calculation.

It will attract an extra 50% depreciation after which it will come down to Free on Board (FOB) then the current exchange rate is applied before the freight and insurance are considered.

The duty likely to be paid on an imported vehicle can be checked in ICUMS using the information below:

- Chassis number or Vehicle Identification Number (VIN)

- Model

- Year

- Make

2. Primary taxations:

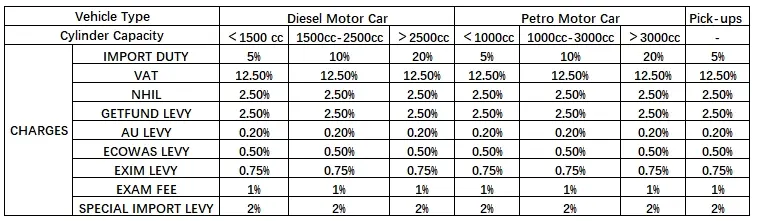

The representation below details the varied charges that form the sum total of tax liability to vehicle importers for different types of vehicles:

- For diesel motor cars:

- Engine displacement not exceeding 1500cc: import duty is 5%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- Engine displacement between 1500cc and 2500cc: import duty is 10%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- Engine displacement exceeding 2500cc: import duty is 20%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- For petrol motor cars:

- Engine displacement not exceeding 1000: import duty is 5%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- Engine displacement between 1000cc and 3000cc: import duty is 10%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- Engine displacement exceeding 3000cc: import duty is 20%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- For Pick-ups:

- Import duty is 5%, VAT is 12.5%, NHIL is 2.5%, GETFUND LEVY is 2.5%, AU LEVY is 0.2%, ECOWAS LEVY is 0.5%, EXIM LEVY is 0.75%, SPECIAL IMPORT LEVY is 2%;

- Notes:

- Import duty is based on the CIF Value;

- VAT is on the duty inclusive value (CIF + Duty + NHIL + GETFUND LEVY);

- Overage penalty is based on CIF Value;

3. Third Party Charges:

- Local shipping line charges paid to the carrier

- Terminal handling charges

- Safe bond terminal handling charges (optional) rent for the car whilst it is in the terminal

- Trade number plate GH₵154

- Clearing Agent charges

Relevant Documentation for Vehicle Clearing:

- Manufacturer's name and address

- Year of manufacture

- Value of the used car delivered to your door

- Ownership and registration certificate

- Purchase invoice (original)

- Insurance documents (original)

- Bill of lading (original)

- International driving license

- Customs form C-12 (SAD)

Clearing Without an Agent:

It is possible to clear a vehicle at the port without the assistance of an agent. However, to do this, one needs to register with the Customs Division of GRA as a Clearing Agent.

The individual needs to put in the request in writing or apply electronically, to the Commissioner–General, to be a Clearing Agent.

Secondly, the individual needs to go through all the necessary processes put in place by the Authority before approval of his/her eligibility is granted.

Please refer to https://gra.gov.gh/customs/customs-agents/ to see the detailed process for becoming a customs agent.

Please Note:

Vehicle importers need to make the needed inquiries with relevant parties before they carry on any importation of vehicle(s) to prevent difficulties in meeting all the clearing requirements at the ports of Ghana.

Once a consignee has the Title and Bill of Lading of the vehicle, they can pay duty before it arrives at the port.

No one is exempted from payment of duties except the President, state institutions and diplomatic missions. In cases where a vehicle has to be sold by any of the aforementioned to an individual or private company, duties have to be paid before the change of ownership is made.

Taxation on Electric Vehicles:

Late last year, some great incentives for electric vehicles were announced in the 2024 Budget Speech presented by Ghana’s Minister for Finance and Economic Planning:

- Waive import duties on the import of electric vehicles for public transportation for a period of 8 years.

- Waive import duties on SKD and CKD electric vehicles imported by registered EV assembly companies in Ghana for a period of 8 years.

- Extend the zero rate of VAT on locally assembled vehicles for 2 more years.

This policy will definitely encourage Ghana local assembly and manufacturing of EV vehicles and the import of EV vehicles for public use. While EV cars for private use are not mentioned on the speech, we believe the relevant policy is coming soon. So for used car importers in Ghana, it is vital to look into China’s used electric car market for now.

Market Trends:

Used car import plays an important role in Ghana’s automobile market, accounting for nearly 90% of all imported vehicles with a total volume of around 90,000 annually and this trend is expected to continue due to the affordability of used cars.

China has been the market with the most cars produced and sold in the world, and every year, millions of used cars are sold in China domestically which means China's used cars market can offer overseas buyers competitive prices. Plus, cars in China are left-hand drive, which fits with Ghana's import rules naturally. As China's new car exports keep going up, the export of used cars will rise too. For Ghana, the great value of China’s used cars will become an obvious choice.

In Conclusion:

To make your trade safe and profitable, it is crucial to understand the taxation and policies for importing used cars from China to Ghana. China's EV advantages can enhance the competitiveness of Ghana car traders with adequate sources. Begin your journey of importing Chinese used vehicles to Ghana on this basis!

Please note that used car import tax rates and policies may change over time or be adjusted according to the latest regulations from the government. Therefore, it is advisable to confirm the most current tax information with relevant tax and customs authorities before importing.

Shanghai

2025.048,600kmPHEV

Fuzhou

2020.0995,000kmPetrol

Nanjing

2022.0980,000kmHybrid

Meizhou

2021.0645,000kmPetrol

Huizhou

2021.01130,000kmBEV

Anqing

2024.066,800kmPetrol

Ningbo

2024.0420,000kmBEV

Shenzhen

2022.0367,000kmBEV

China Auto Daily丨Chery Plans $800M ASEAN Plant in Vietnam Launching Mid-2026

Chery invests $800M for Vietnam plant with 200,000 annual output by 2030. China's NEV exports soar 62% YTD. Hunan EV exports surpass RMB 10B. Waymo boosts self-driving tech.

cls · 2025-12-25

China Auto Daily丨XPENG Targets L4 Autonomous Driving Leap in 2026

XPeng targets L4 autonomous driving leap in 2026, China ranks among top global manufacturers with NEV dominance, Sigmastar to mass produce L3+ LiDAR chips.

China Automotive News · 2026-01-04

Revealed: The Top 5 Chinese EV Startups of 2025 - A Fierce Battle for Dominance

The top five Chinese EV startups of 2025, led by Leapmotor and Huawei-backed Harmony Intelligent Mobility Alliance, showcased exceptional delivery growth and strategic global expansions, setting the stage for fierce 2026 competition.

Leapmptor · 2026-01-04

China Auto Daily丨BAIC Group to Begin B30 SUV Assembly in South Africa Early 2026

BAIC starts B30 SUV assembly in South Africa; SAIC debuts IM LS9 flagship SUV; GWM launches ORA 5 EV pre-sales; global EV sales grow 23% in October 2026.

cls · 2025-11-13